If you’re a freelancer, you’re most likely a sole proprietor. And as such, you may be wondering, “Does a sole proprietor need an EIN?” And the answer is: No, there is now law requiring that a sole proprietorship. However—there is one reason why you may want to get one anyway.

Read on to find out more.

What Is an EIN?

EIN stands for Employer Identification Number, and it is a type of Tax Identification Number (TIN) just like a Social Security Number (SSN). The IRS issues EINs, which help the IRS to track your income, and therefore, track how much taxes you owe.

Can a Sole Proprietor Have an EIN?

Yes, a sole proprietor can have an EIN, but they are not required to have one—even so, I highly recommend that EVERY freelancer get an EIN. I am a sole proprietor, and I have an EIN.

The Benefits of an EIN for a Sole Proprietor

So why would you want to get an EIN as a sole proprietor even if you’re not required to have one?

Having an EIN can help prevent identity theft by protecting your Social Security Number. If you do not have an EIN, you must use your SSN in its place.

The most common place where you will use your SSN/EIN as a freelancer or sole proprietor is on W9s that you must fill out for clients so that they can issue you 1099s.

Think about it: When you’ve just been hired by someone new, they’re going to ask you to submit a W9, often via email. Two risky things here:

- You hardly know this person. Do you really want to give your Social Security Number to a stranger?

- Emails are not secure, generally. Do you really want a hacker to be able to find your SSN via email?

The way to circumvent these two risks is to get an EIN so that you can use it instead of an SSN on your W9 forms.

Please note that EINs can get stolen too, so you don’t want to go flaunting yours around. However, EIN theft is a significantly lower risk than SSN theft.

How to Get an EIN as a Sole Proprietor

Thankfully, applying for an EIN from the IRS is a simple procedure. It is free, and you can do it online in five minutes!

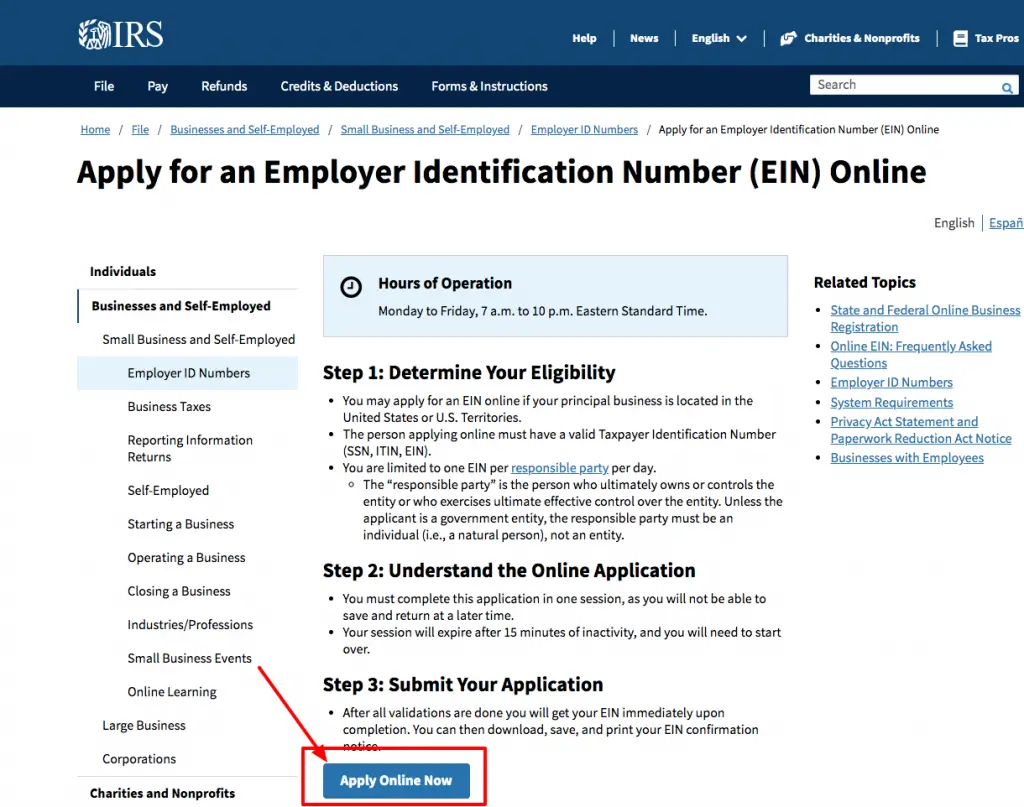

Step 1: Use the EIN Application Tool on the IRS Website

Apply for an EIN on the IRS website

**Important** You can only apply Monday to Friday from 7 a.m. to 10 p.m. (Yes, I know, totally weird that an online tool has operating hours!)

Step 2: Complete the application.

Step 3: Get Your EIN! BE SURE TO SAVE IT

As soon as you complete your EIN application, the IRS will give you an EIN online, along with an EIN letter. Be sure to copy this EIN somewhere safe and/or save the letter.

How to Use Your EIN as a Freelancer

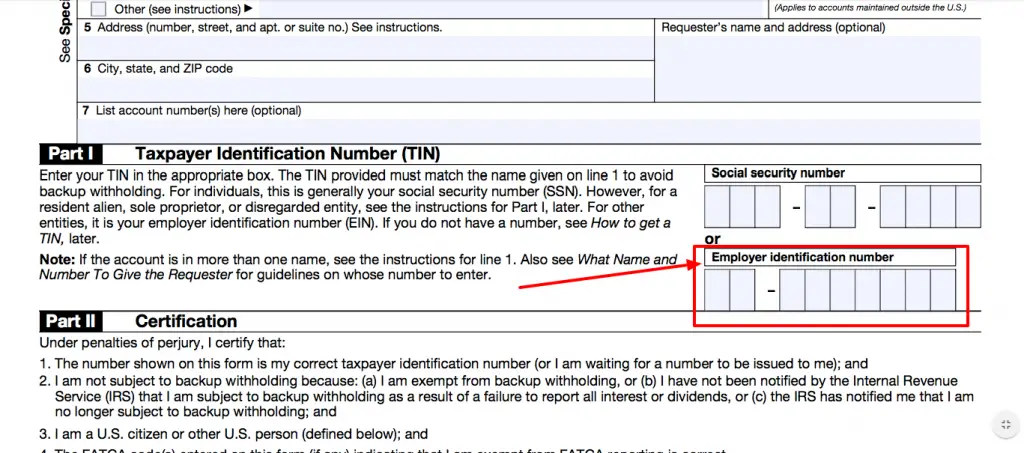

Again, as a freelancer, your will probably only ever need your EIN when a client asks you to fill out a W9 so they can send you a 1099 later.

On the W9, where it asks for a Tax Identification Number, put your EIN—do not put your SSN.

On your tax return, Form 1040 with a Schedule C, you will use your SSN not your EIN. And don’t worry, the IRS will still be able to match your 1099s to your SSN because when you applied for your EIN, you had to tell the IRS your SSN so that they could match it. So no worries!

Learn more about how to fill out a W9 as a freelancer

If you are a single-member LLC, learn how to fill out a W9 HERE

Add comment