When I switched from a sole proprietorship to an LLC in 2019, one of the biggest hurdles I hit was figuring out how to fill out a W9 as a single-member LLC.

*Disclaimer: I am not a tax professional, so the following is not tax advice. Please seek the advice of an accountant or other qualified professional.

Which Name to Put on Line 1

As a single-member LLC, you should put your first and last name on Line 1 of the W9—not your LLC name.

Which Name to Put on Line 2

As a single-member LLC, you should put your LLC name on Line 2.

Which Box to Check on Line 3

As a single-member LLC, you are automatically categorized as a “disregarded entity” and thereby taxed by the IRS as a sole proprietor. UNLESS you elect to be taxed as a corporation, you will check the box that says “Individual/sole proprietor or

single-member LLC.”

Should I Put My SSN, Sole Prop EIN, or LLC EIN on Part 1 (Taxpayer Identification Number)?

Shockingly, I couldn’t find any agreement on whether to use:

- My Social Security Number (SSN)

- My sole prop’s Employee Identification Number (EIN)

- Or my new LLC EIN

Here’s the deal: When you are a sole proprietorship, you can fill out W9 forms using your SSN. But it is recommended to apply for an EIN anyway because it’s better to give out the EIN on a W9 form than your SSN.

To further complicate matters, when you form an LLC, you can apply for a new EIN for the LLC (which is separate from your sole proprietorship).

And then to really complicate things, in the eyes of the IRS, a single-member LLC is a sole proprietorship because you default to a “disregarded entity” (unless you elect to be taxed as a corporation).

So that leaves that burning question: Which number do I use on my W9s if I’m a single-member LLC?

The answer is not so simple.

I asked more than a DOZEN accountants that very same question, and the answers varied. The most COMMON answer was that you should use your LLC EIN.

But…I don’t think that’s technically the right answer.

If you follow the rules set forth by the IRS, you should use your SSN or your sole proprietorship’s EIN, not your LLC’s EIN.

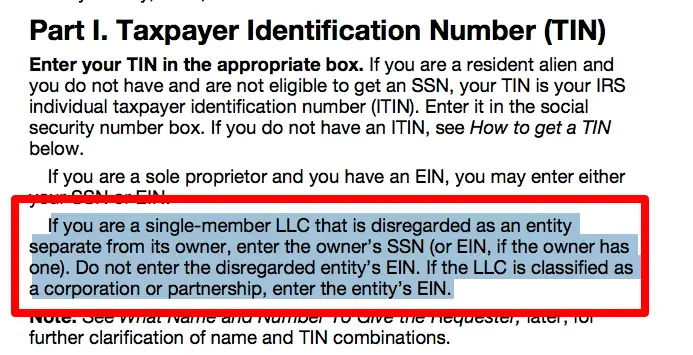

Want proof? Here are the EXACT instructions that are printed on the IRS W9 form:

It says, and I quote:

If you are a single-member LLC that is disregarded as an entity

https://www.irs.gov/pub/irs-pdf/fw9.pdf

separate from its owner, enter the owner’s SSN (or EIN, if the owner has one). Do not enter the disregarded entity’s EIN. If the LLC is classified as a corporation or partnership, enter the entity’s EIN.”

But when I confronted accountants about this, almost ALL of them said, “Yeah…but no one really does that. All my single-member LLC clients use their LLC EIN, and we’ve never had any problems.”

My CPA advised me, however, that I should strictly follow the IRS’s rules and put my SSN or sole prop EIN because if I were ever to be audited, saying, “I followed the IRS rules as printed on the W9 form” is a much better defense than saying, “Well, everybody else is putting their LLC EIN.”

Personally, I put my sole proprietorship’s EIN on my W9s now that I’m a single-member LLC. But when I opened my LLC bank account, I gave the bank my LLC EIN. I know, I know. So complicated.

In the end, it’s up to you. But please speak with a qualified accountant to decide what to do based on your situation.

Whoops–please remove my previous comment that’s awaiting moderation! – Fritz

Thank you SO much for sharing this–this was incredibly helpful, because as a new single-member LLC (no previous sole proprietorship) encountering my first W-9, I also had been completely stuck on having to provide my SSN on the form.

It sounds like getting an EIN as a sole proprietor provides a solution, happily (if what seems like a ridiculous solution), and I have a couple questions for you on this.

While putting your sole proprietor EIN on your W-9s, I was wondering:

1. Did you decide to list your LLC name, sole proprietor business name, or no business name on Line C (Business name) of Schedule C when you file your taxes?

2. Similarly, which EIN (if any) did you decide to list on Line D (Employer ID number) of Schedule C when you file your taxes?

Thank you again, and looking forward to hearing back!

Hello ! Just curious, did you encounter any issues after using your sole prop EIN in W9s filed in the context of your LLC? I have been wondering if using my old sole prop EIN (which account I had previously closed with the IRS) would create a TIN mismatch.

Hey Vali!

No, I have not encountered any issues after using my sole prop EIN on W9s for my single-member LLC. *However*, I also did *not* close my sole prop EIN account with the IRS. I suggest checking with an accountant in your case.

Your posts are extremely helpful and I wish I had found you sooner! I am a sole proprietor just starting out, and will likely (hopefully!) need to change to an LLC once my proverbial ball is rolling. I was just curious, however, if I had started out as an LLC (skipping sole proprietorship altogether), then I would only have an LLC EIN. So following the IRS instructions to the letter, I would’ve had to put my SSN on the W-9? The point of having an EIN is so you don’t have to give out your SSN, and the point of having an LLC is to keep business and personal assets separate–the IRS instructions seem to combat that. Or am I misunderstanding something?

Hi Kari! First, congratulations on starting your own business! 👏🏽. Second, that is an excellent question! I’m not an accountant, so I can’t give professional advice on taxes and such, but it would seem to me that your point is correct: Having to give out your SSN on a W-9 if you only have an LLC EIN and are taxed as a sole proprietor would defeat the purpose of having an LLC and an EIN to keep yourself separate from your business and protect your SSN. Perhaps that’s why so many accountants I spoke to told me that their single-member LLC clients who are taxed as sole proprietors simply put their LLC EIN on the W-9 even though it’s *technically* against IRS rules. What a headache, I know!

I think the workaround here is just going ahead and getting a sole prop EIN and using that when you’re an LLC. Otherwise, you can always do what most single-member LLCs do and put your LLC EIN on the W-9 even though that’s not what the W-9 instructions say. I hope that helps! And of course, always check with your accountant to ensure you’re doing what’s best for your unique situation.

This is very helpful and a frequent topic of debate all over the Internet. I already had an EIN for the LLC (“Company Name LLC”), but I just went to the IRS site and got an EIN for me as sole proprietor doing business as “Company Name” (no LLC).

What still trips me up is that the IRS says you can’t have an EIN for yourself as sole proprietor if your business is an LLC, and that seems to force you back into using your SSN on the W9. When I entered the name of my LLC on the form, it told me that “LLC” is not allowed in a name of a non-corporate entity, so my only option was to create the EIN without LLC in the DBA name. This still feels wonky, but I do NOT want to be giving out my SSN to every Joe Purchasing Clerk. The IRS really should clear this up.

I’ll be using my sole proprietor EIN on W9’s from now on, though, instead of the LLC’s. Hopefully this works. I actually have a certain major fruit-named company as a customer who insisted I put my SSN on the W9 though. I wonder if they’ll now accept this instead.

Was anyone able to get a DEFINITE answer to this?

I only have a LLC EIN. I talked to someone at the IRS and they say use SSN but many accountants say not to. Who to believe? If the only penalty is withheld payments, then why not use the LLC EIN and just change it to SSN on the W-9 if trouble arises? I believe that’s the only thing that will be required if an issue arises.

THANK YOU for this post! I have been frantically Googling ever since trying to fill out my first W-9 since changing from sole proprietor to single-member LLC. I was told by multiple professionals that I needed an EIN for my new LLC, so the W-9’s insistence that I provide my SSN (which seems illogical and a step backward) has me very confused. I can’t say this post has cleared it up, but at least I’m not alone in my confusion. 😉

You are 100% correct ! Thanks for sharing these..

A single-member LLC entity that has not selected to be treated as a corporation with the IRS should put his/her name on line 1 on W9 form instead of LLC’s name and should put SSN or EIN of sole proprietor on PART I, Not EIN of LLC’s.

Which EIN do you put on line D of Schedule C, though? Your sole prop EIN or your LLC’s EIN?

…For single-member LLCs, the Schedule C instructions say to put the “EIN that was issued to the LLC (in the LLC’s legal name),” but if you have all your 1099s with your sole prop EIN on them, don’t you worry that the IRS is going to expect you to file a Schedule C with your sole prop’s EIN on line D?