Congratulations! You’ve decided to start a freelance business. Now, the confusing legal stuff starts, namely, how to get a freelance business license.

I promise you it is not as hard as it seems. Registering as a freelance business when you work from home is actually SO much easier than any other business type. I mean think about it: A restaurant would have to get all sorts of health permits and inspections, and anyone constructing a brick-and-mortar building for their business would have to apply for building permits.

As a freelancer, you typically just need a business license (also known as a business tax receipt in some places). You just need to know where to start.

Laws vary by city, county, and state, so please be sure to check with your local government to learn the details of the process as it is specific to your area. But for the sake of example, below, I will use San Francisco and San Francisco County.

3 Things to Do Before You Apply for a Business License

#1 Decide on Your Business Structure

Now, there are many different types of business structures, but below, I am going to share the two business structures that cover the VAST majority of freelancers.

Option 1: Sole proprietorship – Easiest and doesn’t require any extra paperwork

The sole proprietorship is the most basic business structure you could possibly have. It does not require any extra paperwork. As soon as you start transacting as a business, you are a sole proprietor. When you file your income tax return, you’ll claim your freelancing income on the same 1040, but with an added Schedule C. The sole proprietorship also provides ZERO liability protection, though, so be aware.

Most freelancers are sole proprietors.

Option 2: Limited Liability Company (LLC) – Offers the most protection but requires more paperwork and fees

If you want to protect your personal assets, then you’ll want to form a limited liability company (LLC). It does require extra steps and paperwork, plus an annual fee.

Learn more about the difference between a sole proprietorship and LLC.

This guide applies to sole proprietorships only. If you’re interested in becoming a Limited Liability Company, be sure to check out my guide on how to form an LLC.

#2 [Optional] Register Your Fictitious Business Name (FBN) or Doing Business As (DBA)

If you are freelancing under your first and last name, you don’t need to worry about an FBN/DBA. If you are freelancing under anything other than your first and last name, you might need an FBN/DBA. Check with your local and state government.

EXAMPLE

- Jane Smith Media – This probably does NOT need an FBN as long as your legal first and last name is Jane Smith.

- Butterfly Media – This probably DOES need an FBN because it doesn’t have your first and last name in it.

In some cities, you must get a business license BEFORE you can register your FBN (Example: San Francisco). In other cities, you can register your FBN before or after you get your business license.

#3 [Optional, But Recommended] Get an Employee Identification Number (EIN)

An Employee Identification Number (EIN) is sort of like a replacement for a Social Security Number (SSN). When you have an EIN, you can put that on legal documents, such as the W9 form and your business registration, instead of your SSN. This offers you extra protection and privacy, since you want to be careful who has your SSN.

Getting an EIN is FREE and can be done completely online.

I highly recommend getting an EIN for your freelance business BEFORE you get your business license (as you’ll need it for the application).

Does a freelancer need a business license?

It depends. I’ve lived in cities where freelance writers must obtain a business license or business tax receipt, and I’d lived in cities where those were NOT required for freelance writers.

Most business licenses for freelancers are issued at the local government level—either by your city or county—so that’s where you should start.

For the City of San Francisco and San Francisco County: Yes, you need a business license if you want to be a freelancer, such as a freelance writer. They call it a “business registration certificate.”

Here’s what the San Francisco Business Portal website says:

Every person who engages in business in San Francisco must register at the SF Office of the Treasurer & Tax Collector (TTX) within 15 days of commencing business in the City.

https://businessportal.sfgov.org/start/register-your-business/city-registration

4 Easy Steps to Register Your Freelance Business

Step 1: Start with Googling, “business licenses [city name/county name].”

Once you identify if business licenses are issued by your city or your county government—and in some cases, it’s both!—you know which entity to contact. Sometimes, you’ll find all the info you need directly on the website of this government entity. But if it’s confusing, just pick up the phone and give them a call, or visit them in person to get things sorted out.

In San Francisco, the Office of the Treasurer & Tax Collector issues business registration certificates.

Step 2: Fill out the paperwork.

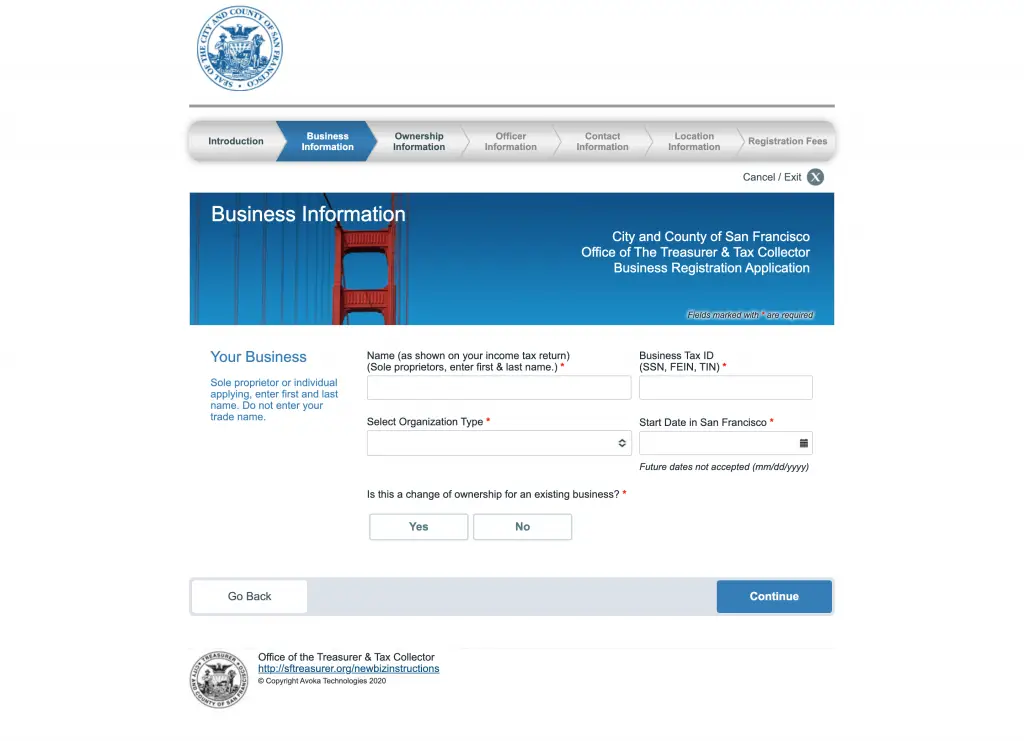

For the City and County of San Francisco, you can register your business by filling out an online application.

In other cities, you may need to print out the form and turn it in in person. But you can always ask if they can email you the PDF so you can type on it and e-sign it, and then email it back to them.

In most cases, you’ll need to correctly categorize your business type on your business license application. This part can be confusing for us freelancers who dabble in a little bit of everything—writing, video production, graphic design, etc. When this happened to me in one city I lived in, I asked the government employee, and she told me to just put the category that MOST applied to me. Since I was mostly doing writing, I put writing instead of photography/graphic design, etc.

Step 3: Pay the fee.

You will have to pay a fee to register your freelance business. For me, this has cost anywhere from about $35 to $50, depending on the city.

Step 4: Make sure to renew it every year.

You must continue to renew your business license for it to be valid. The renewal date depends on the city—it is NOT necessarily on January 1st each year. For example, in San Francisco:

Business Registration is valid from July 1 – June 30, and must be renewed each year by May 31st.

https://businessportal.sfgov.org/start/register-your-business/city-registration

If you renew your business license late, you’ll pay a penalty.

One More Thing: Business Property Tax

There’s one more formality that comes with registering your freelance business: property tax. I know what you’re thinking, “What?? I’m not buying a house or land…why would I have to pay property tax?” It’s this weird little extra thing that some cities/states have, but you probably will not end up owing tax on your business property; you just have to report the value of your property.

In San Francisco, it’s known as the business property tax, and you must file a Business Property Statement by April 1st each year.

In the State of Florida, it’s known as the tangible personal property tax return, and you must file it by April 1st each year.

Whatever it’s called, you most likely will NOT actually owe any tax if your property consists of items such as a laptop, keyboard, mouse, etc. From what I’ve been told (including by a lawyer in SF), this tax really targets large businesses with hundreds of thousands of dollars in equipment.

It will, of course, depend on your situation and your local laws. Be sure to talk to your accountant about this when you’re doing your taxes each year.

Add comment