There are many good reasons to become a freelancer, but a huge downside is that you’ll pay more for health insurance as a self-employed person. While many companies subsidize their employees’ health insurance (paying an average of 82% of the premiums for their employees), freelancers are totally on their own when it comes to paying premiums. Ouch, that’s painful.

Below, I’ll lay out your options for healthcare as a freelancer.

FAQs About Freelancer Health Insurance

Do I qualify for a health insurance subsidy as a freelancer?

You may be able to get a subsidy on your health insurance if your income is below a certain level. That means your monthly premium will be reduced by a certain amount. Check to see if you qualify for a tax credit. As of 2019, you need to be earning below $49,960 to qualify.

To apply for a tax credit for health insurance, you do have to estimate your income. This can be tricky as a self-employed person; freelancers know well the “feast or famine” cycle of this line of work. Thankfully, the government offers guidelines on how to estimate your next year’s income as a self-employed person.

Basically, do your best to estimate what you think your next year’s net income (profit) will be as a freelancer. If you end up making more than you estimated, you may have to pay back any tax credits you took during the year. If you end up making less, you may be eligible for more tax credits. So it can all work out.

What happens if I don’t have any health insurance?

If you don’t have health insurance, at the very least, you might be required to pay a penalty for not having health coverage. To be clear, starting in 2019, the federal penalty is no longer in effect, BUT some states still enforce a penalty.

The worst thing that could happen though is an unexpected health emergency that racks up a bill you can’t pay, resulting in medical debt. This is the biggest reason many people won’t gamble with not having health insurance; you could be one accident or illness away from financial ruin. (I am NOT saying this to scare you, but just know that it can happen. So weigh your options.)

In the U.S., emergency rooms are legally bound to provide care to those who need it, even if they do not carry health insurance. This is not true for other medical providers though. And you would still be hit with a bill that could follow you around for a long time.

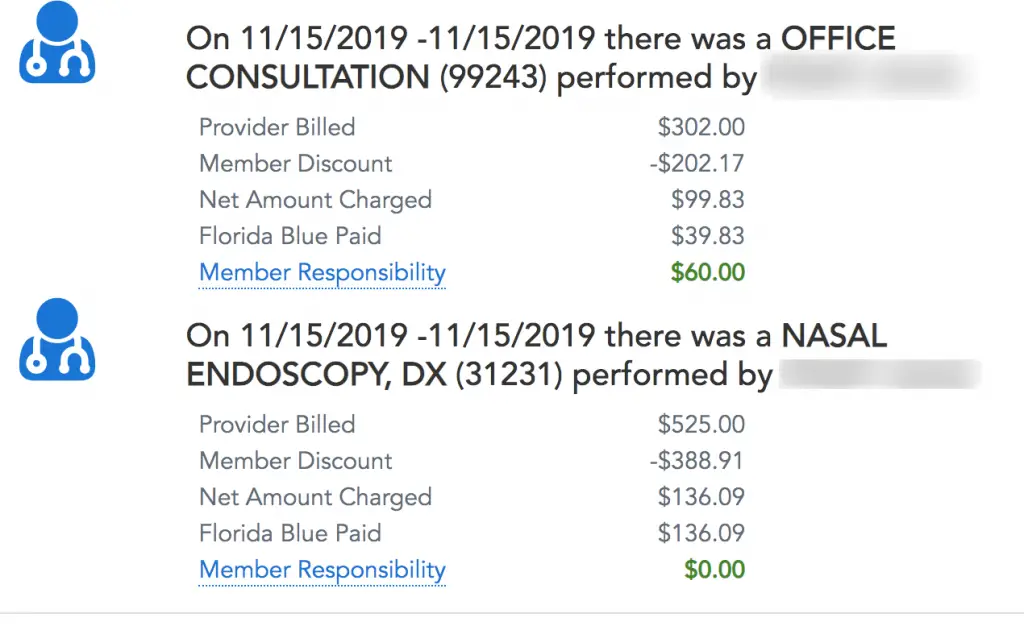

To give you a real-life example of what could happen if you don’t have health insurance: I do have health insurance, and I recently went to an ENT (Ear, Nose, and Throat specialist) for a sinus infection.

Here’s how much the doctor billed my insurance:

That’s right, WITHOUT insurance, that visit to the ENT would’ve cost me $827! With insurance, it cost me $60.

Freelancer Health Insurance Options

#1 Health Insurance Through the Marketplace

If you qualify, you may receive a discount on healthcare through the Health Insurance Marketplace, which is run by the government. You can use the Health Insurance Marketplace so long as:

- You live in the United States.

- You are a U.S. resident or citizen.

- You are not incarcerated.

The biggest advantage to applying through the Marketplace is that you may be eligible for a premium tax credit that way. You can only receive a tax credit, though, if you make below a certain level of income.

#2 Private Health Insurance

If you don’t qualify for tax credits/subsidies, then you can purchase private health insurance. This is what I do. You can buy health insurance through a provider such as Blue Cross Blue Shield and pay 100% of the premium, without the aid of the government or an employer.

For example, for Florida Blue, you would go to their website and fill out an application and get quotes for different levels of health insurance.

You have to do this during open enrollment, unless you qualify for Special Enrollment.

You can also search a health insurance aggregator site like eHealth. This will pull quotes from major health insurance companies like Blue Cross Blue Shield, Aetna, Humana, and more.

#3 Freelancers Union Health Insurance

The Freelancers Union is a good (and free!) resource for freelancers, but it doesn’t offer a group insurance plan (which would make it cheaper for us all). Instead, they simply recommend a private insurer (Oscar). The premiums are equivalent to the premiums I receive for Blue Cross Blue Shield. The premiums will, of course, depend on your personal situation. To be clear, there is no special discount on their health insurance plans for being a member of the Freelancers Union.

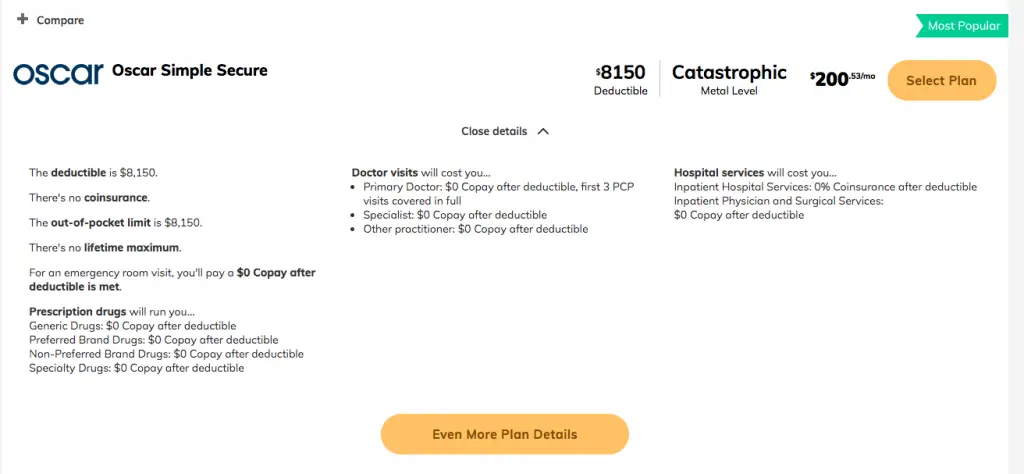

#4 Catastrophic Insurance

If you’re relatively healthy and don’t expect any routine medical costs throughout the year, you could take out catastrophic insurance. This is minimum insurance that covers only catastrophes. As such, it’s much cheaper than higher-level plans. The downside is that you’ll pay for most of your medical care out of pocket until you meet that high deductible. Then, the health plan covers the rest.

As an example, a 26-year-old female in Dallas, Texas, with no tobacco use history would qualify for a catastrophic plan as low as $200/month with Oscar. The deductible and maximum out-of-pocket cost for the year would be $8,150. So essentially, she would need to make sure she has $8,150 in emergency fund savings in case she ends up having an illness or injury that requires her to use that catastrophic plan.

There are requirements you must meet to be eligible for catastrophic insurance:

- You must be under 30 years of age

- If you’re not under 30, you have to qualify for a hardship exemption or affordability exemption.

#5 Short-Term Health Insurance

eHealth has some great info on what a short-term health insurance plan is and if it’s right for you. Some important things to know about short-term insurance:

- It does NOT meet the minimum coverage for the Affordable Care Act, and although as of 2019 there is no federal penalty, you might still be penalized by your state.

- It does not offer the same level of care as major medical coverage.

- It’s best used for when you only need a few months’ worth of health coverage, such as if you’re in between jobs or you plan to buy a major health insurance plan later.

- It does not qualify for the subsidy/premium tax credit.

- It does not cover pre-existing conditions.

Health Savings Accounts

You have the option of opening a health savings account with qualifying high-deductible plans. So you have to health insurance to have an HSA.

An HSA is a savings account where you put money that will be used for future medical expenses; as a bonus, the money you contribute to the HSA is tax-free (but if you withdraw money for NON-medical expenses, that money will be taxed). Find out if an HSA is right for you.

Can’t Afford Freelancer Health Insurance? Here Are Some Options to Consider

Now, I am NOT advocating for going without health insurance. But I understand that some freelancers cannot afford it right now. If that is you, below are some freelancer health insurance alternatives. (But I REALLY hope you can get insured ASAP.)

Savings

Ah, the good ol’ emergency fund. One reason to have an emergency fund is for medical emergencies.

Medical Tourism

This is NOT health insurance, but an option if you don’t have health insurance: You could travel to countries with substantially lower healthcare costs and equally good healthcare quality. This is also known as medical tourism.

Check out the many stories of Americans who traveled abroad for cheaper healthcare.

I have thought a lot about this as I considered downgrading my health insurance to one with less coverage. Traveling for medical procedures in a different country can result in lots of money saved, but that really only works for planned procedures. If you have an emergency (say, getting hit by a car and breaking your leg), you’re not going to have time to book a flight elsewhere to get taken care of. So keep that in mind.

Health Sharing Ministries

It must be stressed that health sharing ministries are NOT health insurance. As such, they do not meet the requirements for health coverage, so you may have to pay a penalty for not carrying health insurance.

Health Sharing Ministries work this way: You and the other members of your Health Sharing Ministry will add your money to a pool. That pool of money covers members whenever they have a qualifying medical need.

Here’s a more detailed post on how health sharing ministries work.

Negotiate Your Medical Bills

The important thing to realize about the insanely high medical bills that are sent to health insurance companies is that they could be high because the provider knows that a health insurance company can and will pay for it. It’s different if your doctor knows you have to pay out of pocket, so you have some leverage. Let them know you’re uninsured and ask if they can work with you. Often, they give discounts for upfront cash payment, or they can work out a payment plan. Always negotiate your medical bills.

Which Freelancer Health Insurance Will You Choose?

The sad reality is that healthcare in the U.S. is so expensive that many cannot afford it. Health insurance can help absorb those costs, but even insurance can be cost-prohibitive. So it’s all about how much risk you are willing to carry.

Add comment